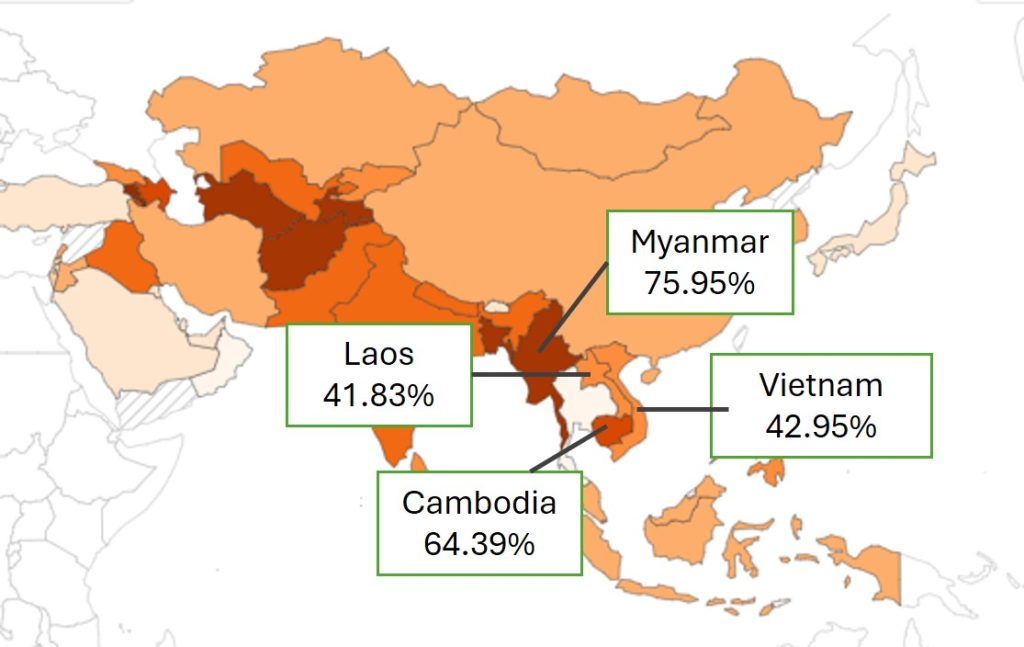

As shown in Figure 1 below, many countries in the Mekong Region have very high out-of-pocket expenditures (OOPE) on healthcare. Even though about 93% of the Vietnamese population was covered by the national health insurance scheme in 2023 [1], household OOPEs accounted for 42.95% of the total health expenditures in 2019 [2]. Currently, locally manufactured products can only meet 53% of the growing pharmaceutical demand [3].

Figure 1: Share of OOPEs on healthcare, 2019

Possible reasons for high drug-related OOPEs

Ageing population

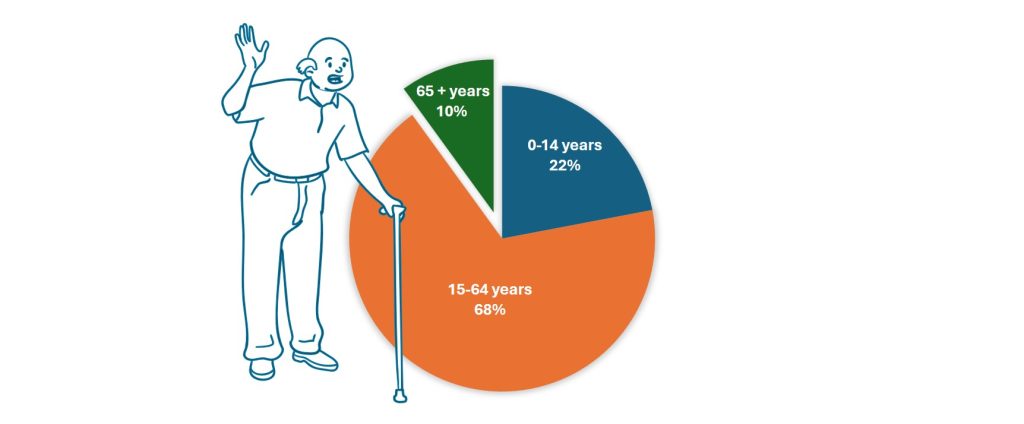

The rapidly ageing population is one of the reasons for an increasing pharmaceutical demand in Vietnam and an increasing likelihood of OOP spending on healthcare. As of 2023, 17% of the population was over 60 years old and 10% over the age of 65. By 2050, more than 25% of the population is expected to be over 60 years old. One of the reasons is the declining fertility rate while life expectancy is increasing [4].

Figure 2: Population per age group, 2023

(OOPEs for health care refer to payments households make when they use healthcare services, including the purchase of medication, the payment of hospital user fees, payment for diagnostic services and other expenses.)

Drug prescription preferences

According to Circular no 52/2017, single and generic prescribing is recommended, provided that prescriptions are considered safe, rational, and efficient. Research from 2009 divulged that doctors were likely to prescribe innovator brands and generic medicines from Europe as these drugs were believed to have a better reputation, higher quality, and efficacy [5]. Policies could be put in place to affect these preferences, such as announcing the quality standards achieved by less expensive generic drugs, and generic substitution policy. But this is not yet in place so preferences persist. There is an overall perception that “expensive is good”, which may lead to health practitioners suggesting more expensive drugs, pharmacists advising switching to more costly drugs, while patients don’t pushback to demand lower cost drugs.

Awareness

While Vietnam’s government has a substantial number of measures in place to ensure drug quality [6], the people are not aware of these and there are incentives for doctors to prescribe higher priced drugs. Hospitals are reimbursed by the Vietnam Social Security (VSS) for curative care, which creates incentives to increase the number of healthcare services offered and the possibility that costly, additional, or unnecessary healthcare services are being recommended [7].

Solutions focusing only on limiting payments for pharmaceuticals, such as mandatory generic substitution policy, might not succeed in reducing the excess spending on drugs. Instead, the focus also needs to encompass the perceived quality issues, raising awareness of drug quality measures among Vietnam’s population.

Accessibility and affordability

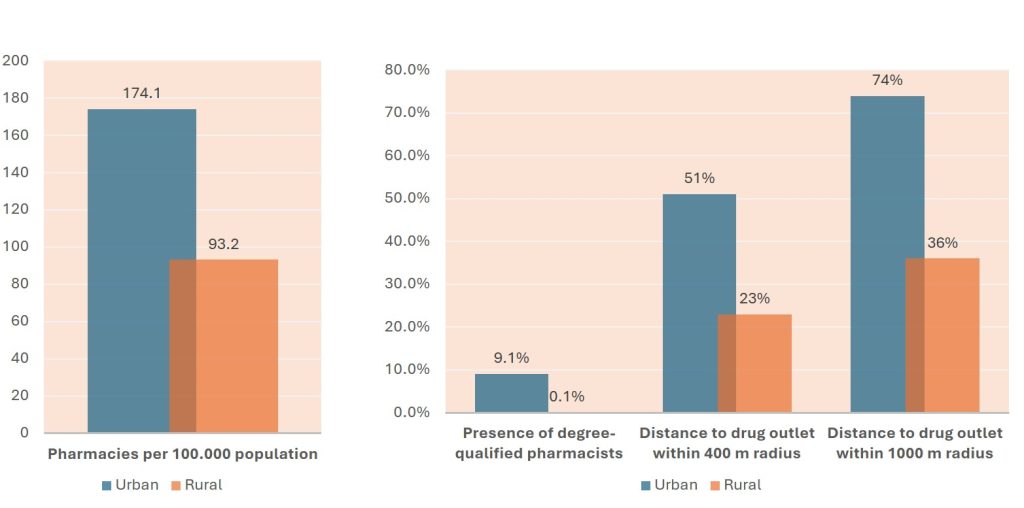

A 2017 review of Vietnam’s healthcare reform revealed that the quantity and quality of healthcare services are lower in rural areas compared to urban areas [8]. The geographical imbalance in the distribution of qualified healthcare workers and drug outlets results in a high concentration in metropolitan centres and a shortage in rural and remote areas [9,10]. More drug outlets should lead to more competition that pushes prices down but it may also mean greater use of unnecessary drugs.

Figure 3: Distribution of drug outlets in rural vs urban areas

(Base: 1,972 drug outlets across four provinces in Vietnam, 2019)

Pharmaceutical retail units remain the preferred point of access. A study by the EU-Vietnam Business Network (EVBN) found that 80% of individuals in Vietnam buy drugs from private pharmacies and self-medicate. [11] In 2023, interviews with qualified pharmacists in Ho Chi Minh City indicated that hospital pharmacies would not sell drugs without a prescription, but individually owned and rural pharmacies may sell prescription drugs, such as antibiotics, without a prescription. [12]

Further research into drug prescription processes, availability, prices, and patients’ perceptions of pharmaceuticals could help the government identify shortcomings of current processes. This in turn could open opportunities for future revision of regulations determining drug procurement, prices, and prescription standards.

If you found this article useful, please remember to ‘Like’ and share on social media, and hit the ‘Follow’ button to never miss an article.

About the authors: Daniel Lindgren is the Founder of Rapid Asia Co., Ltd., a management consultancy firm based in Bangkok that specializes in evaluations for programs, projects, social marketing campaigns and other social development initiatives. Denise Erber, a co-author, is a M.Sc. student in Global Study and worked as a project assistant intern at Rapid Asia.